average clause underinsurance formula|Average Clause in Fire Insurance : Pilipinas Condition of average (also called underinsurance in the U.S., or principle of average, subject to average, or pro rata condition of average in Commonwealth countries) is the insurance term used when calculating a payout against a claim where the policy undervalues the sum insured. In the event of partial loss, the amount paid against a claim will be in the same proportion as the value of the . Ridgefield, WA 98642 General Information: 1.877.GO.ilani For assistance in better understanding the content of this page or any other page within this website, please call the following telephone number 1.877.GO.ilani

PH0 · What is the Average clause in Insurance?

PH1 · What is an average clause?

PH2 · Unraveling the Under

PH3 · Understanding the Average Clause in Motor Insurance: A

PH4 · Understanding the Average Clause in Insurance

PH5 · Understanding Average Clause: Definition, Purpose, and Examples

PH6 · Underinsurance and the Average Clause

PH7 · Condition of average

PH8 · Average clauses in insurance policies

PH9 · Average Clause in Fire Insurance

The 2024 Super Bowl is seven days away, and the latest odds are out for who will be crowned the champion of this NFL season. Since the San Francisco 49ers and Kansas City Chiefs won their .

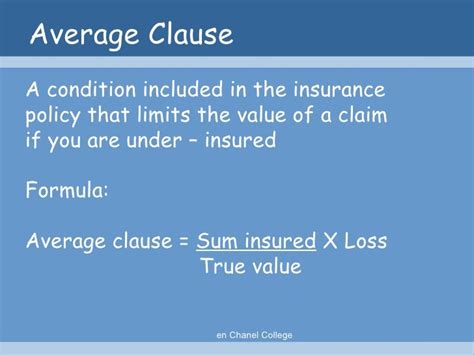

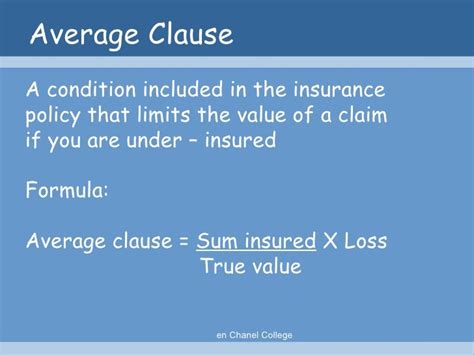

average clause underinsurance formula*******The formula employed to calculate the claim amount under the Average Clause in Fire Insurance is as follows: Claim Amount = (Sum Insured / Actual Value of Property) × Loss Amount. Breaking down the formula: Sum Insured: This denotes the insured amount specified in the fire .

Nob 24, 2020 — The average clause only applies when the sum insured is less than the actual value of the goods or the property. The amount of claim that the insured gets is calculated as follows: Claim amount = (Actual loss × .average clause underinsurance formulaHul 16, 2024 — The Average Clause, also known as the Condition of Average, is a crucial component in motor insurance policies that addresses the issue of underinsurance. To .Nob 14, 2023 — Calculating The Average Clause Underinsurance Formula So, what do the average clause and underinsurance have to do with each other? Here’s the gist: When .Condition of average (also called underinsurance in the U.S., or principle of average, subject to average, or pro rata condition of average in Commonwealth countries) is the insurance term used when calculating a payout against a claim where the policy undervalues the sum insured. In the event of partial loss, the amount paid against a claim will be in the same proportion as the value of the .Insurers apply the average clause and only payout a proportionate amount for what you are claiming based on how much you are underinsured by. The average clause is there to ensure .Dis 6, 2018 — So what is an average clause in an insurance policy? It is a clause requiring that you bear a proportion of any loss if your assets were insured for less than their full .

Ago 7, 2023 — The Basics of the Under-Insurance or Average Clause: The under-insurance or average clause is designed to address situations where the insured value of an asset is less .

The primary purpose of an Average Clause is to ensure that policyholders adequately insure their property. It prevents underinsurance by penalizing the insured proportionately if the declared .In simpler terms: If your insured property is worth £100,000 but you only insure it for £80,000 (undervalued), you are underinsured by 20%. In the event of a total loss, the average clause .

Peb 9, 2016 — This technical briefing helps you understand how Average in an Insurance Policy applies to an Insurance Claim and how it relates to sums insured. Call us on 01926 674 875 Email us at [email protected]. .Average Clause in Fire Insurance Peb 9, 2016 — This technical briefing helps you understand how Average in an Insurance Policy applies to an Insurance Claim and how it relates to sums insured. Call us on 01926 674 875 Email us at [email protected]. .Set 16, 2022 — Coinsurance Clause or Average Clause An insurance policy for a property owner is accompanied by a detailed and complex contract that will contain clauses, provisions and responsibilities that are assigned to either the policy holder or the insurer. One of these provisions is the coinsurance clause. Coinsurance is quite often misunderstood and it inclusion in

Nob 14, 2023 — Average clause calculation: Although insurance documents are rarely simple, the average clause calculation (or ‘average clause underinsurance formula’) is fairly easy to understand. . Using the formula for the average clause that we’ve just tackled, let’s take a look at some real-world examples of the clause in action:

the ‘Average’ clause which may be included in your policy wording. Making . claims clear. . Underinsurance and ‘Average’ 6 Your broker, or usual AXA contact, will be able to assist you in establishing what should and shouldn’t be included. Also consider other factors, such as whether a building is ‘listed’, the quality of any .

Hul 6, 2022 — For instance, if a company insures a building asset for less than the full cost of rebuilding it (e.g. $6 million out of $10 million, or 60%), the Average Clause, which states that the insurer will pay in proportion to the amount of underinsurance, will apply in the event of a claim. This is illustrated in the table below:Ago 7, 2023 — The Basics of the Under-Insurance or Average Clause: The under-insurance or average clause is designed to address situations where the insured value of an asset is less than its actual value. In .Hul 6, 2022 — For instance, if a company insures a building asset for less than the full cost of rebuilding it (e.g. $6 million out of $10 million, or 60%), the Average Clause, which states that the insurer will pay in proportion to the amount of underinsurance, will apply in the event of a claim. This is illustrated in the table below:

Ago 14, 2024 — In case of under-insurance, the insurance company will apply the Average Clause. However, the Average Clause limits the liability of the insurance company to a loss amount that is in proportion to the covered and uncovered sum insured. The actual amount of the claim is determined by the below formula:Peb 26, 2024 — Coinsurance Clause or Average Clause An insurance policy for a property owner is accompanied by a detailed and complex contract that will contain clauses, provisions and responsibilities that are .Hul 18, 2024 — The answer is not ₹20 lakhs, but ₹16 lakhs. That is because the average clause will apply and reduce your claim amount by 20%. Here is the average clause formula to calculate the claim amount: Claim Amount = (Sum Insured / Actual Value of Property) × Loss Amount . Claim Amount = (40 / 50) × 20. Claim Amount = 0.8 × 20,00,000Calculating The Average Clause Underinsurance Formula. So, what do the average clause and underinsurance have to do with each other? Here’s the gist: When you're underinsured, the average clause means you don't get a full payout. The average clause lets insurers adjust their payouts in line with your underinsurance.

Ago 14, 2024 — Discover what the average clause in fire insurance means, how it affects your policy, and why it's crucial for homeowners. Learn more. +91 9696683999. Chat with us. Whatsapp us. . A fire insurance policy has an average clause mentioned in it which takes care of the cases of under-insurance. If insured the assets in the fire insurance policy .

The average clause is a way of insurers paying out less than they need to if a policyholder is paying less than the premium they should be because they have inadequate cover. Insurers apply the average clause and only payout a proportionate amount for what you are claiming based on how much you are underinsured by.Hun 26, 2023 — The average clause, also referred to as the “underinsurance clause” or “co-insurance clause,” is a provision commonly found in fire insurance policies. Its primary objective is to ensure that policyholders adequately insure their property to avoid potential financial loss in the event of a partial loss or damage caused by a fire.May 21, 2021 — Under the Average Clause the insurer can then reduce the claim amount by the same proportion as the amount of underinsurance (10%) – so a £240,000 claim becomes £216,000, leaving the business financially liable for the £24,000 difference – even though they had £1.8 million of insurance in place.

Ago 21, 2023 — Under-insure or under-insurance is when the insured value is lower than the actual market value of the insured asset. This could be the value of your car and your home when you purchased your insurance. . the “average clause” applies. To get the “average clause” figure, use the following formula: So with the average clause in place .Mar 31, 2023 — What is condition of average clause? . The formula for calculating underinsurance is: Sums insured /replacement cost X the loss amount = The claims settlement*. The example used earlier in this article shows that if a home has a rebuild cost of €300,000 but is only insured for €225,000, i.e., only 75% insured, that means that it is 25% .Ene 31, 2020 — The result is that you will only be paid a proportional part of your claim. In the event of a claim, the principle of ‘average’ would be applied. The formula determining average is as follows: (Sum Insured / Value at Risk) x Amount of Loss. Example. Let’s say Keith’s townhouse is insured for R500 000, but it’s actually worth R1 million.

Contextual translation of "pangungupit" into English. Human translations with examples: pilferage.

average clause underinsurance formula|Average Clause in Fire Insurance